In the US, the Securities Exchange Commission (SEC) requires publicly traded companies to provide them.

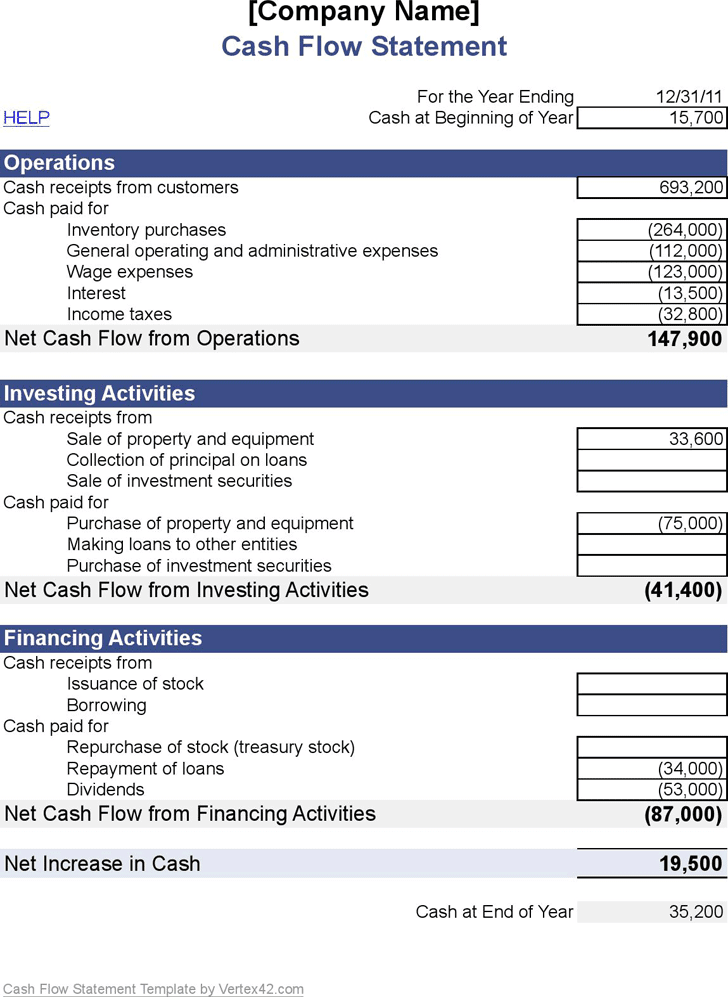

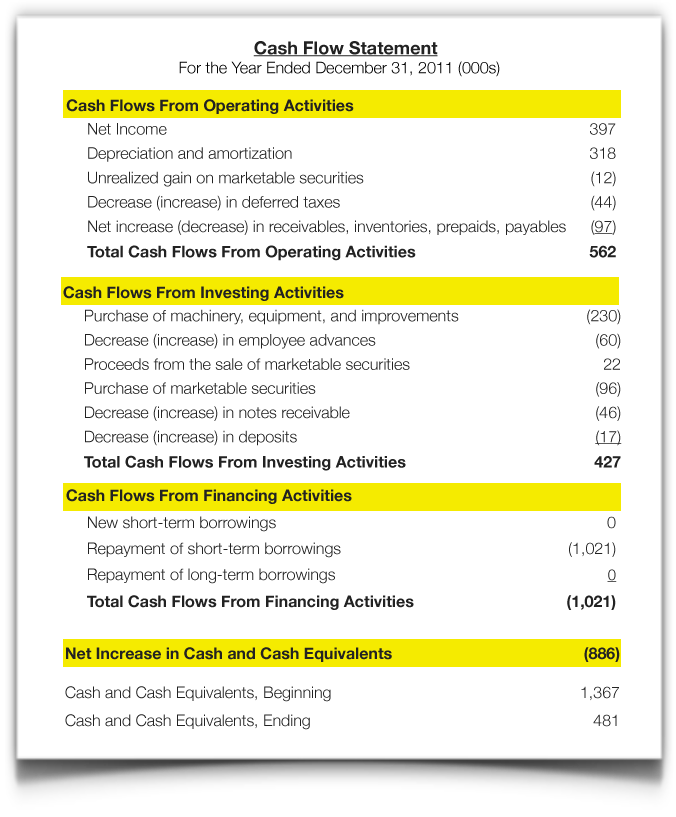

Together, they depict a company's finances. The others are the income statement and balance sheet. "Cash flow statements really just show business operations' impact to cash," says Dondrea Owens, CPA and founder of The Creative's CFO.Ī company's cash flow statement is one of three key reports that investors and other interested parties use to determine its financial performance. Usually, cash flow is divided into three main categories: operations, investment, and financing. In conjunction with other documents, cash flow statements can help you understand how financially healthy a company is. Using the information contained in a cash flow statement, business owners, shareholders, and potential investors can see how much cash a business is bringing and how much it's spending in a given period. What is a cash flow statement?Ĭash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company - both what comes in and what goes out - during a certain period of time. The cash flow statement is one of the most important to understand. By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept ourĬompanies with stocks that trade on public exchanges are required to periodically disclose a wide range of documents with detailed information about their operations.

0 kommentar(er)

0 kommentar(er)